020519_YKBP_A3.pdf

Why

settle

for

ust a

lice …

hen 100% of

your retail

market

eceives The

roadcaster.

Broadcaster is the

imary medium

successful

businesses

used to reach their

omers for over 50

. Your Broadcaster

s more advertising

l other local media

Broadcaster Press 3

February 5, 2019 www.broadcasteronline.com

The Snow

Challenge

Dave Says

Let Her Take Care Of The Payments

By

Daris Howard

Eight fourteen-your-old boys, two leaders, and six snowmobiles—what could possibly go wrong?

I was one of the fourteen-year-olds, and it was to be our

January scout camping trip. We would snowmobile in to a

big, open meadow and set up camp Friday evening. We would

spend the next day snowmobiling in the meadow. Then, an

hour before dark, we would head for home.

All went as planned the first night. We set up camp and

ate dinner. We went to bed early so we could get up at first

light and have a full day riding the machines.

The next morning there was only a glimmer of light in the

east when we woke. By the time there was enough sunlight

to ride without the machines’ lights on, we were off racing

across the meadow. After lots of riding, we moved to another

fun event. We tied ropes fifty feet long onto the snow machines and tied the other ends to inner tubes.

“Howard,” Rod said, “I bet you can’t stay on that inner

tube with me driving the snow machine.”

I accepted his challenge and climbed on the inner tube

like a cowboy climbing into a chute on the back of a bull.

I grasped the rope securely with both of my glove-covered

hands and laid down. Rod sat down on the snowmobile and

gunned it forward.

Rod would bring the machine up to the fastest speed

he could, about fifty miles per hour, then he would turn as

sharply as he could without rolling the snow machine. This

whipped me at about twice that speed in an arc across the

snow. The snow crystals bit into the exposed areas of my

face. I even rolled over a couple of times on the inner tube.

But even while being dragged through the snow, I held on,

determined to win the challenge.

The day was spent with everyone challenging each other

to see if they could throw them off of the inner tubes. When it

was almost time to leave, only Rod and I had not been thrown

off. Before heading back to where the snowmobile trailers

were waiting, the other boys egged us on to see if one of us

would be the ultimate champion.

Rod said he’d try to throw me first. For about twenty minutes, he rode at full throttle, crossing rough trails, turning at

high speeds. The ice crystals cut into me to the point I felt

they were surely drawing blood. But I held on, and finally, it

was my turn to drive.

As he grabbed the rope, he grinned. “All right, Howard.

Give me your best shot.”

I, too, did the same as Rod had done. I pushed the machine to the limit across some of the roughest tracks and

spun the machine in as fast and tight of circles as I could. But

Rod held on no matter how hard I tried. I could see the sun

sinking in the sky, and knowing my time was running out, I

got a brilliant idea.

On the far side of the meadow was a ridge where the snow

had drifted especially deep and thick. It had formed a wall

of snow about eight feet high and around ten feet in depth.

It was also nearly vertical. I opened the throttle and headed

for this wall of snow. I estimated the distance of the rope and

the speed, and not far from the snow wall, I started the turn.

The rope whipped Rod toward the wall. I knew if I had

estimated it right, he would hit the wall at peak speed, just

as the rope went tight. It was almost perfect, and when the

inner tube hit the wall, the g-force and the crash combined

ripped Rod from the rope. But my fourteen-year-old brain

didn’t consider what would happen after that. The inertia

shot Rod directly into the wall of snow like a human rocket.

He disappeared right up to his boots. Suddenly, the thought

went through my head that I had killed him.

The leaders and other boys must have thought so, too,

because they came flying toward us on the snowmobiles. We

dug around Rod’s legs, then got a few of us on each leg and

pulled him out. He was sputtering and spitting snow, but he

was mostly fine. So much snow was rammed down his coveralls that he couldn’t move, and we had to help pull them off

of him and unpack the snow.

When we were sure he was okay, our leaders just sighed

and looked at me, shaking their heads. Finally, the oldest one

spoke.

Dear Dave,

My daughter is in college, and

I’ve always warned her to stay

away from credit cards. Recently, I

learned she got a department store

credit card despite my advice. She

has stayed within her credit limit,

but she has never made any of the

payments. At this point, she owes

about $3,500. She’s a good student,

and I want to look at this as a young

person’s mistake. Should I pay it off

for her this one time?

Joseph

You probably know the answer to this question immediately, right? Would you rather spend your time shopping at the

mall or updating your budget in Excel?

The spender and the saver are total opposites, but it’s

true what they say—opposites attract. Often in marriage, one

person is a spender and one is a saver. And that’s okay! Just

because one likes to spend and one the other likes to save

doesn’t mean your marriage is doomed. You balance each

other out.

The problems start when you go through life without

understanding each other’s natural tendencies. You have to

start by embracing one another’s differences. There is no right

or wrong here. The key is to communicate and make a plan for

your money together. Spenders shouldn’t let all of the budgeting fall to the saver and vice versa. You are one now!

Dave

3. Do I understand how a budget works?

Dear Joseph,

If you don’t know how to make a budget, stop what you’re

You’re right, this is a typical young doing and learn how to create one. I know what you may be

person’s mistake. Like a lot of mistakes our kids make, it’s one

thinking… “Budgets are the worst!” or “You can’t have fun

that’s bad and wonderful at the same time. It’s bad because, if

when you’re on a budget!” Budgeting might seem restrictive

she had just listened to dear old dad, she would’ve avoided a

but telling your money where to go instead of wondering where

mess. It’s wonderful, though, because it gives you the opportu- it went actually gives you permission to spend! It’s also a great

nity to provide her with a real world, teachable moment.

way to deepen communication with your spouse because

I understand you wanting to help her out “this one time.”

you’re planning for your future together.

It means you have a good heart, and that you care about your

Your budget is your game plan. With a zero-based budget,

daughter and love her. There’s a reality here, though, I hope

you list your monthly income at the top of the page. Then list

you won’t overlook. It’s her debt, not yours. She knew what she all your monthly expenses—gas, food, rent, debt payments and

was doing when she signed up for that credit card. She knew

so on—below that. The income minus the outgo should equal

what it meant, what was expected, and she is the one who

zero. Every dollar should have a “name.” Give yourself grace. It

should have to make good on the repayment. The entire deal is will take a few months to get used to budgeting, but you’ll get

legal and fair.

there!

At this point, my advice is to put your arm around her, talk

4. What are your financial fears?

to her, and lovingly explain where she went wrong and why it

This might not be a fun question, but it’s an important one.

was a bad idea. You can even help her find a part-time job if she Fear can make us do crazy things, especially when it comes

doesn’t have one right now, so she can pay off her debt and get to your money. Fear is what leads to people hiding purchases

out of this mess. But leave the payments to her. My guess is by from their spouse or getting a secret credit card. Both of which

the time she finishes working her tail off to pay this debt she

are bad ideas, by the way!

will have learned a lesson she’ll remember for the rest of her

Maybe you’re afraid because you don’t have the security

life!

that comes with savings or maybe you’re scared because

— Dave

you’re living paycheck to paycheck, like most Americans. Whatever they are, share them with your fiancé. Getting your fears

out on the table will help you to get on the same page when it

* Dave Ramsey is America’s trusted voice on money and

business, and CEO of Ramsey Solutions. He has authored seven comes to your values and money.

5. What are your dreams?

best-selling books, including The Total Money Makeover. The

Where do you picture yourself (and your spouse) years

Dave Ramsey Show is heard by more than 12 million listeners

each week on 575 radio stations and multiple digital platforms. from now? What type of lifestyle are living? You probably

already know the answer, and these are things you should be

Follow Dave on Twitter at @DaveRamsey and on the web at

sharing with each other, too.

daveramsey.com.

Talking about money with your partner binds you on an

intimate level unlike anything else. You wind up sharing your

hopes and dreams together, and who doesn’t want that? The

honeymoon doesn’t have to end when your wedding is over.

Dream together, and make a plan for your money together.

By Rachel Cruze

I promise, you’ll add a sense of peace in your marriage that

Marriage is one of the biggest decisions you’ll ever make, so could not exist with debt!

the last thing you want to do is go in unprepared.

Money is the number one issue couples fight about. In fact,

*As a #1 New York Times best-selling author, host of The RaRamsey Solutions released a study that shows money fights are chel Cruze Show, and The Rachel Cruze Show podcast, Rachel

the second leading cause of divorce, behind infidelity. So, mak- helps people learn the proper ways to handle money and stay

ing sure you’re on the same page about your finances with your out of debt. She’s authored three best-selling books, including

future spouse is extremely important. When you sit down and

Love Your Life, Not Theirs and Smart Money Smart Kids, which

talk with your partner about your finances, it builds a different she co-wrote with her father, Dave Ramsey. You can follow

level of trust in your relationship. You’ll wind up growing closer Cruze on Twitter and Instagram at @RachelCruze and online at

to each other as a result.

rachelcruze.com, youtube.com/rachelcruze or facebook.com/

Talking about money can be uncomfortable at first, but it’s rachelramseycruze.

so worth it! Before you say “I do,” here are a few questions you

should ask yourself as you get ready to have the money talk

with your future spouse.

1. Where are you currently with your finances?

Both of you should answer this question and get it out on

the table. How much debt do you have—including student

Support the Clay County 4-H Program by

loans, car loans, mortgages, credit cards and even personal

purchasing delicious, high-quality fruit.

loans? What’s your annual income? How much do you have in

savings?

Contact Colleen at the Clay County

Once you both have that information, you can make a plan

Extension Office at 605-677-7111

to attack your debt. That leads us to a very important question—do you want debt to be a part of your marriage? I hope

or clay.county@sdstate.edu

the answer is no, but you need to have this discussion. If you’re

to request an order form or place an order.

determined to get out of debt and your spouse continues to

pile up credit card debt, then you’re headed toward a lot of

Fruit orders will be taken until February 18

marital stress.

with fruit delivery around March 14.

Debt is a thief. It steals your money and your joy. The last

thing you want to do is delay

all of those dreams you have

with your future spouse. Being

debt free will allow you to

turn your dreams into a reality. So, make a plan to get out

of debt together, and don’t let

it be an option ever again.

You should feel loved,

2. Am I a spender or a

saver?

safe and respected

Ramsey

5 Questions to Ask Yourself

Before Marriage

019 4-H FRUIT SALE

2

LOVE IS MANY THINGS, BUT...

NEVER ABUSIVE.

Athlete Spotlight

Why

settle for

just a

slice …

Why

settle for

just a

slice …

When 100% of your

retail market

receives The

Broadcaster.

The Broadcaster is the

primary medium

successful

businesses

have used to reach their

customers for over 50

years. Your Broadcaster

carries more advertising

than all other local media

combined. And, like our

customers,

we continue to grow.

Broadcaster

201 W. Cherry St.

624-4429

When 100% of your

retail market

receives The

Broadcaster.

Why

settle for

just a slice

When 100% of your retail

market receives

The Broadcaster.

The Broadcaster is the

primary medium

successful

businesses

have used to reach their

customers for over 50 years.

Your Broadcaster carries

more advertising than all

other local media

combined. And, like our

customers,

we continue to grow.

The Broadcaster is the

primary medium

successful

businesses

have used to reach their

customers for over 50

years. Your Broadcaster

carries more advertising

201 W. Cherry St.

than all other local media

624-4429

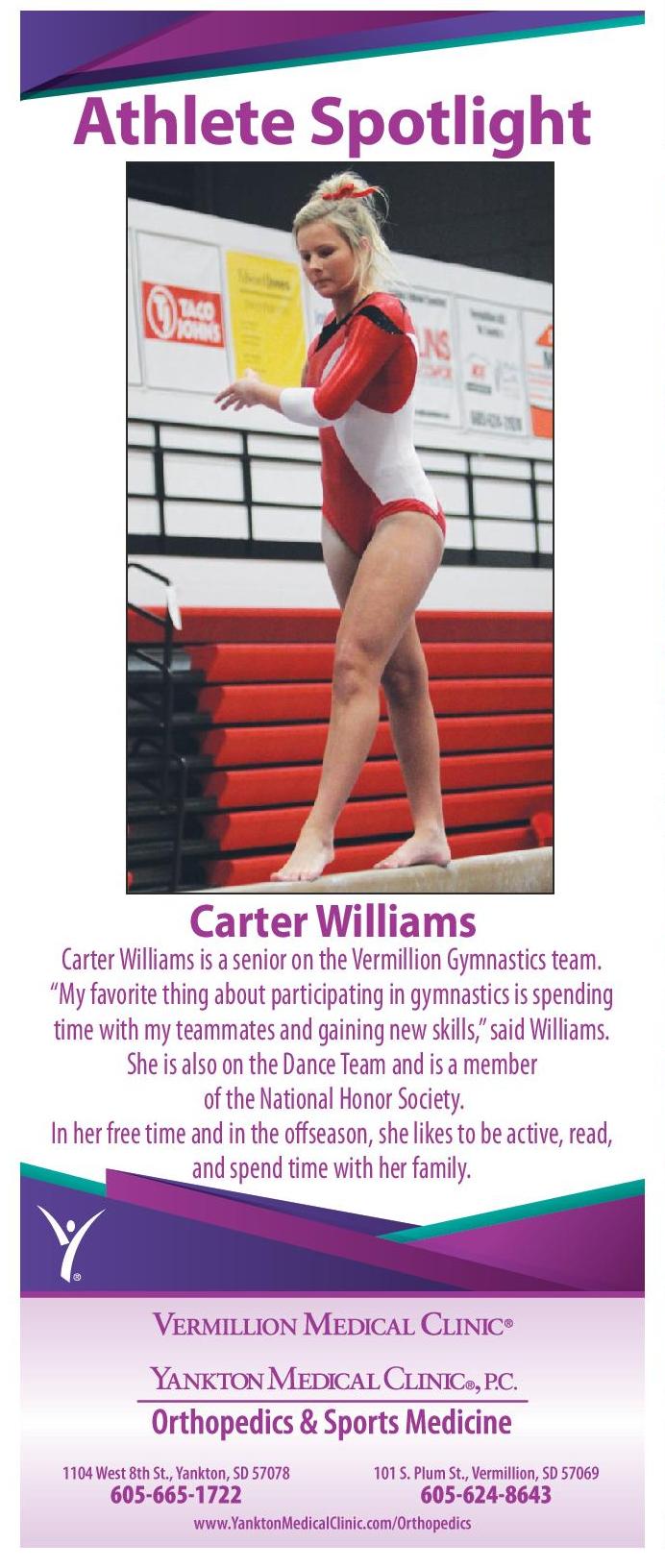

Carter Williams a senior

combined. And,islike our on the Vermillion Gymnastics team.

customers,

“My favorite thing about participating in gymnastics is spending

we continue to grow.

Broadcaster

Carter Williams

time with my teammates and gaining new skills,” said Williams.

She is also on the Dance Team and is a member

1x5

of the National Honor Society.

201 W. Cherry St.

In her624-4429 the offseason, she likes to be active, read,

free time and in

and spend time with her family.

Broadcaster

1x6

Why settle

for

just a slice

Summer

When 100% of your retail

market receives

The Broadcaster.

in Vermillion • Serving Clay, Union,

Turner Counties in South Dakota

605-624-5311

Recreation

Starts February 4th thru May 3rd

The Broadcaster is the

primary medium

successful businesses

have used to reach their

customers for over 50 years. For

Players 5-12 Years Old

ToBroadcaster Parks and Recreation tab at www.vermillion.us

register visit the

201 W. Cherry St.

Any questions

624-4429

1x4

email tylert@cityofvermilliom.com

Previous Page

Previous Page